|

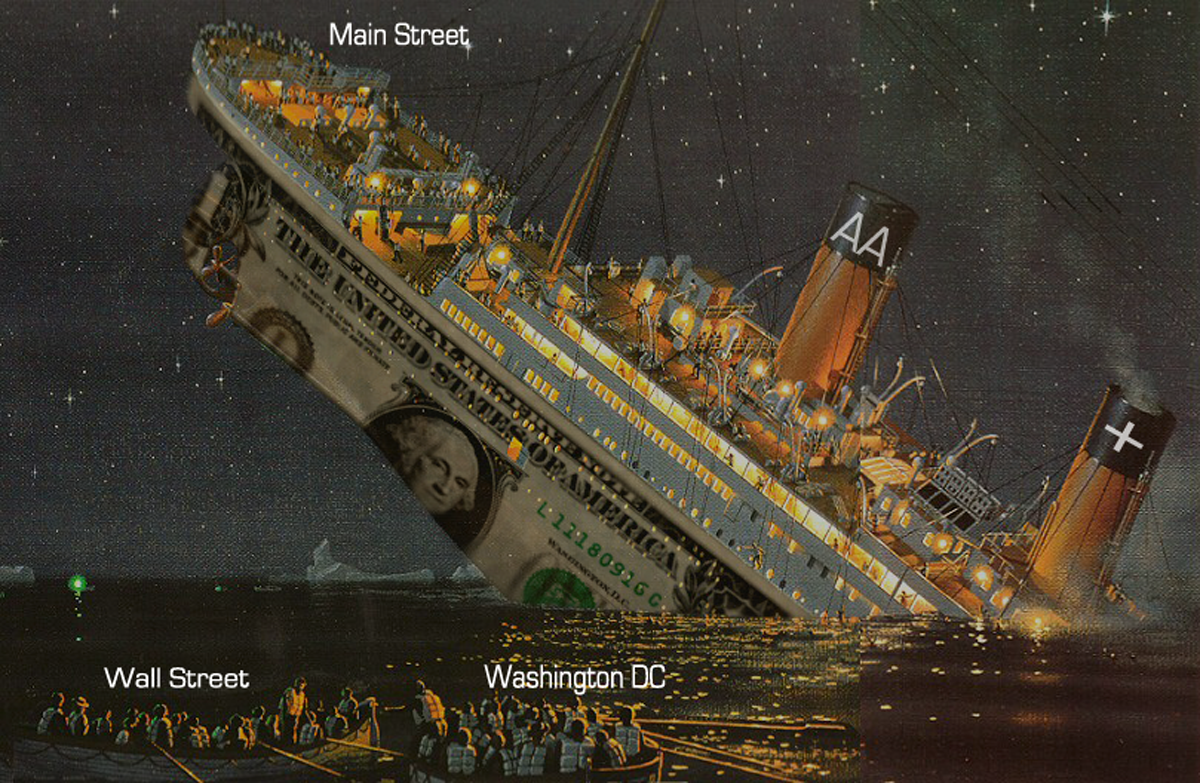

| A Night To Remember By WB7. Visit His Site For Great Stuff! |

Not one week ago, we warned that due to the compounding nature of

We said when we return next Tuesday (today) that we would discuss other "events" including the housing situation. Well, we have good news and bad news for you. The good news is housing is dead. The bad news is housing is dead. Needless to say, people want to get out of their homes, like right now but due to this wonderful "economic green shoots recovery" (hey, look! The Dow is up to 12,800! Everything must be great!) nobody is buying. And why would they? Better yet, how can they?

Historically, housing (and real estate in general) was a relatively safe investment - one that usually appreciates in value over time and one necessity you actually build your dreams in. However, more and more people are waking up to the fact that their home values have plunged to levels not seen in 10 or more years - in some cases, levels not seen in 20 years. The picture is far, far worse when you consider property taxes and inflation over that time. Inflation alone has eaten up a whopping 17% of your real time purchasing power since 2008. In short, housing is in a death spiral for which there is no recovery. The house you are living in now, most likely will be the home you will be living in for the next, who-knows-how-long. Everyone knows this but no one wants to admit it.

Did we mention the giant 2.7 million shadow inventory lurking right around the corner?

Therefore, we can plainly see the inevitable outcome, and to answer the question at the outset, to print will ultimately be what the Dr. orders in the form of QE2.1 (followed by QE2.5 and QE3), because we all know who well the first round of QE1, QE1 Lite and QE2 worked out for everyone... we're still waiting to feel the "wealth effect" Dr. Deficit. Perhaps QE3 will not come today, but soon and the name will be changed to something softer. Perhaps, "Monetary Smoothies."

Speaking of the poverty effect, Dr. Deficit just shot a dead cat down Wall Street for the bounce this morning. Any whiff of QE3 in today's 2:15 PR, and the markets will rally (for inflation). But maybe they realize throwing money into an endless pit doesn't work after all (see also: Greece) it just makes everything expensive for the average Joe.

Of course, with China's CPI pushing now 6.5%, or a hot inflation level not seen since the hot inflation spike of 2008, we doubt China will continue to buy

Any seasoned investor knows that this is not a market to invest money in if you want to have access to it later. Needless to say, if the markets were to drop to more fundamental levels (read: 4500 Dow), there would be a market holiday called and everything closes. Even banks. Nothing instills confidence like closing shop for a day, or month.

We're sure the bimbos on CNBS are cheering the massive London riots (which are now spreading fast) as bullish for the global economy, just like Fukushima was über bull...ish. Think about the hundreds if not thousands of homes and businesses that were burnt to the ground and will need to be built. That will mean more jobs. More jobs means more tax revenue for the insolvent cities. More tax revenue means more more more of everything! Green shoots! See, total bull...ishness for the economy. And that my friends, is why they get paid the big bucks - like CEO's of insolvent banks who are under investigation for massive fraud and write cheap prep rally letters to their employees. Epic. Fail.

Speaking of epic fails, ever notice how incredible market volume flows return when the markets plunge 600 points but volume dries up to barely a trickle when the markets rally. Yeah, that's the confidence in the markets we're talking about. Like confidence you can hope in - as Greece and South Korea ban all short selling. Yeah, that works well. We know free markets always operate freely when the big hand moves things around to benefit itself. That's how you spell confidence.

The same confidence can be found in the thousands of municipal bonds that the S&P just downgraded. In other words, no bond is safe. No dollar is safe. No stock is safe. No single country is safe. Now look at gold. $1777 today and not far off from many of our one liner jokes - $2000 by the time we come back (today). We don't pretend to know where "the markets" will be going but one thing is certain - gold (and by extension silver) is going higher no matter what Dr. Deficit chooses to do. All the fancy wording in their press releases won't buy them a single day more when the SHTF. And yet, gold will go higher. "To the moon, Alice!" And best of all, you don't need a

Speaking of the SHTF, one of Dr. Deficit's top advisers, Nathan Sheets

"This is why so many CEOs are bailing out with insane profits from questionable practices which would normally ruin their career for life, as they have raped their corporation (the latest is Grasso of the New York Stock Exchange); but they know the game is over, and it is now or never - this is their last chance to make millions and move to an island, for insiders are able to see that the economy is literally going to hell, and it will not climb out of hell in their lifetimes. (Some of these characters believe they have a room reserved underground to protect them from what is coming. Some are correct in thinking this, some are not. But many of those underground cities will be death traps, so you had better think twice before paying millions for your reservation. There are earth changes coming that will fundamentally rearrange the crust of the earth, most likely including your future bedroom.)"

Greek bank deposits declined to levels not seen since 2007 - in other words, the people don't trust their money in the banks. Bank runs are taking place across Greece (and the whole EU) very silently (Shhhh don't panic the sheep).

The past week has been one wild ride, to say the least, of which you can be sure is just the tip of the iceberg. The global Titanic hit the iceberg back in 2008 but remember, as with most icebergs, 90% of its mass is unseen.

Which is why our GEES scale has exploded in excitement from a high 5 to the maximum level 7 in a single day, and then back to mid 6 as the anomalies were purged from the algo (in other words, our algo has a few kinks to work out). Nevertheless, the GEES scale has settled much higher than before - currently hovering about 3/4 of the way on level 6. This is where we stand as per our definition:

Level 6- This is the final stage before imminent collapse. Governments continue to drown in debt and sovereign defaults begin (check!) Central Banks enact all emergency measures available to them (check!) Fiat money "printing" increases dramatically and Quantitative Easing returns in other forms and under another name (soon to be check!) Social unrest and tensions are explosive (double check!) Violent mass protests erupt around the world (check!) Bond yields of insolvent peripheral nations skyrocket (check check and check!) Central Banks attempt to contain the contagion (check!) Financial risks are very high (big check!) Municipal defaults occur (14000 checks!) Unemployment increases dramatically (100% check!) Economic activity slows rapidly (check and check!) All emergency measures are implemented to keep economy alive as hyperinflation spreads rapidly across the globe (soon to be check!) Gold and silver skyrocket (check for gold now check for silver later check!) Oil prices become nearly unattainable to most consumers (soon to be check!) Tensions between ally nations rise, leading to political rifts (the big final check!)

[Note: Bold highlights added for emphasis.] We think this speaks for itself. What has increased the danger? One major variable of the GEES algorithm is the VIX (volatility index) which in recent days has gone absolutely bonkers (which in part is why the GEES scale went off the chart and sent the algo flying off a handle) and this is a major component of the fear factor. The other is the price of gold which has skyrocketed to new highs - but not just the price but rather it's the pace at which gold has increased. That is an important factor. Let us not forget such variables as U.S bond yields which took the fear factor down a few notches as yields plummeted(!) - bringing the GEES to low level 6 - but then shot straight up on volatility and market volume and the great sell off began. Then there is the major factor of the U.S. debt downgrade to be followed by thousands of municipal downgrades and many, many corporate downgrades. We'll begin, ahead of the crowd with a BofA long term unsecured debt downgrade of B to D for default (read: insolvent without endless funny money). Outlook negative. But that's a whole 'nother story.

In the meantime, with the GEES scale now at .75 (+/- .25) level 6, it's only a matter of time now before it moves into level 7 territory and the real fireworks begin. Oh, and Fukushima? You can scratch off "visiting Japan" from your bucket list.

For now, there is more than enough doom in the financial markets to digest so we will leave Fukushima updates to another day. In the meantime, hold on to your hats! Tomorrow is another day.