About the author: John Lounsbury

- Company: John B Lounsbury CFP

- Blog: Global Economic Intersection

Only 18% of employees at US corporations will have a retirement income sufficient to maintain their standard of living. This is the result of a study by Hewitt Associates . Those who have a defined contribution retirement plan will meet only 74% of their retirement income needs and that includes Social Security income. It is this analyst's opinion that Social Security income will most likely be reduced below current levels in the future making the situation even worse.

Retirement Savings Need

A report on the gloomy outlook for future retirees is found at Financial-Planning.com. The author, Paul Menchaca, summarizes the results of the study:

Of the 15.7 times final pay, Hewitt estimates that Social Security will provide 4.7 of it, leaving employees responsible for making up the remaining 11 times final pay. This will likely have to come from company-provided plans and personal savings, but of the more than 2 million employees at 84 large U.S. companies it examined, Hewitt’s study found that only 18% of these people who are expected to work a full career will meet this goal.

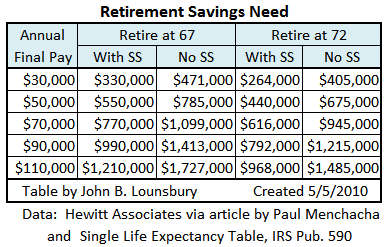

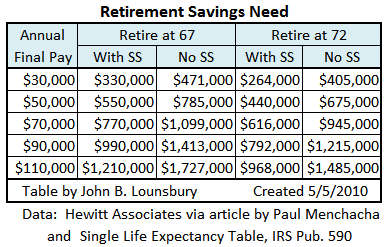

This means that retirement savings requirement for various final pay levels are as shown in the following table. (Note: The article does not specify the retirement age reference for the study. I have assumed they used 67, the age for full Social Security benefits for most workers today. I have made calculations using the single life expectancy tables from IRS Publication 590.)

Retirement Savings Need Likely to Increase

Retirement Savings Need Likely to Increase

Retirement savings need will most likely shift up from the quantities shown with Social Security in future years, as benefits will probably scale down, especially as other income increases. Those with final annual pay of $30,000 may not lose significant benefits, but those at $110,000 could receive only part of the benefit under the current formula.

The retirement savings need will fall somewhere between the two numbers given at each age, subject to the following factors:

- Future inflation rates averaging close to the number assumed by Hewitt. That value was not given in the Menchaca article.

- The numbers are for average life expectancy. If you live much longer than average, the savings need calculated is insufficient. Of course, if you die earlier than average, you would need less.

- Joint and survivor needs will be different than shown. The savings need will increase as age differences of spouses widens if the above calculations are applied to the older partner.

How Can You Address the Problem

For any individual there is a tremendous range of outcomes different from the averages. Good luck figuring out where you will fall in the actuarial table. There are two guidelines that are not likely to fail:

- Estimate the longest you think you might reasonably live and then plan for ten years more than that; and

- Never spend more in any year than you take in. Be sure you add investment losses to your spending. If you have a negative year, cut back until you are even again.

Just remember that running out of money before you run out of time is much worse than running out of time before you run out of money.

So 82% of corporate employees with defined contribution retirement plans are projected to fall short of the needs calculated. On average, 74% of retirement needs will be achieved. That means that 50% will fall below 74% of need. That is a huge shortfall. Possible solutions are given by the Menchaca article:

Hewitt recommends three steps employees can take to curb their savings shortfall: Start saving, regularly increase contribution rate and work longer.

This is essentially what was concluded in the investing for retirement panel in which I participated a couple of months ago. Some commenters ridiculed that as being helpful advice. Sometimes the obvious truth is not readily accepted.